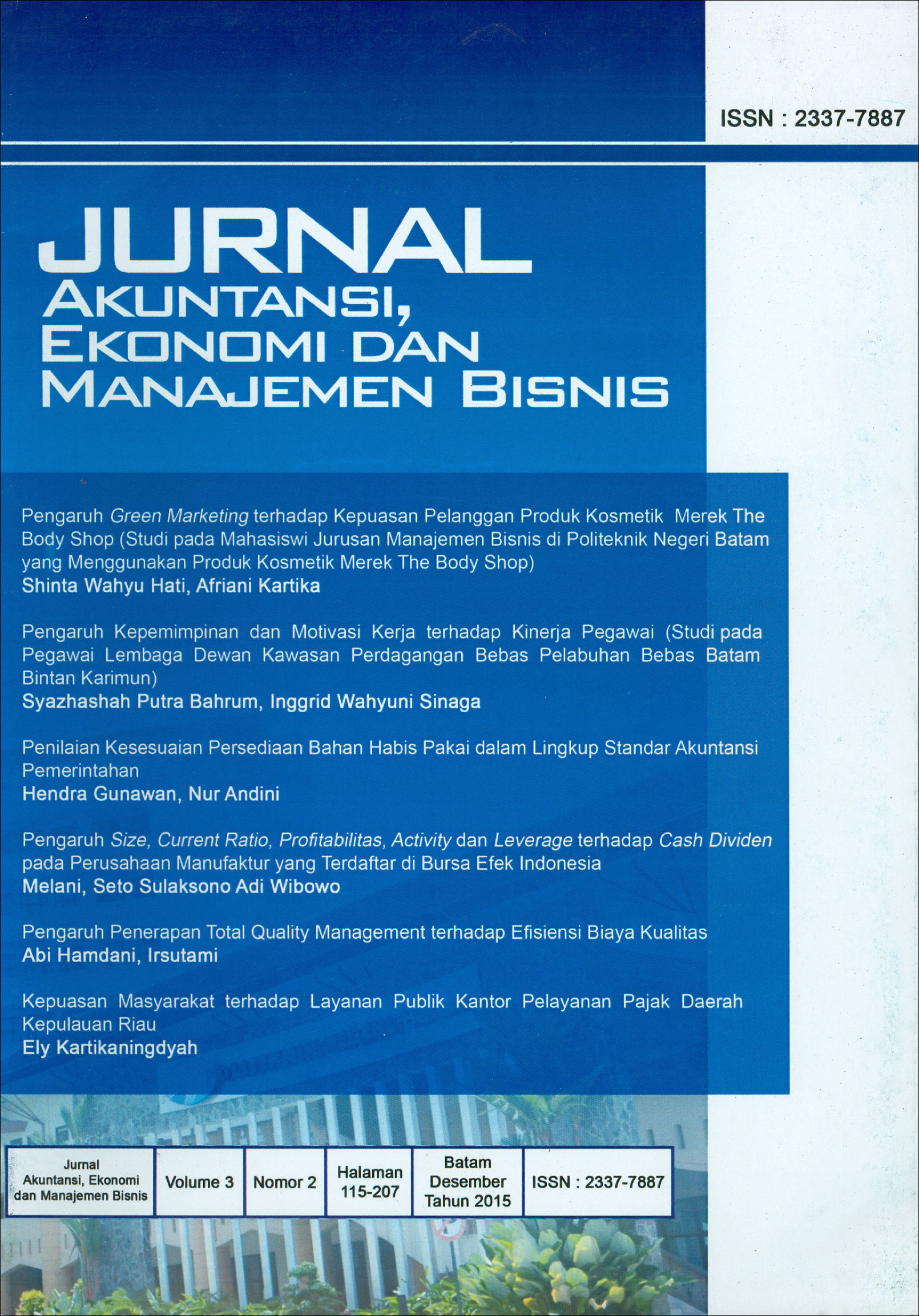

Effective Tax Rate: Efek dari Corporate Governance

DOI:

https://doi.org/10.30871/jaemb.v3i2.174Kata Kunci:

Effective tax rate, Corporate governance, Corporate tax planningAbstrak

This research investigate the influence of corporate governance mechanisms on the effective tax rate (ETR). The sample is 27 listed companies in the Indonesia Stock Exchange in 2010 "“ 2013. The results show that the board size, proportions of independent board, institutional ownership, and the internal audit committee has a significant effect on effective tax rate, while managerial ownership has no effect. This result indicates that efectiveness of corporate tax planning depend on firm corporate governance mecanism.